Huong Dan Khai Thue Nhat Ban Cho Nguoi Nuoc Ngoai 2026: Huong Dan Day Du Bang Tieng Viet

Tuyen bo mien tru trach nhiem: Bai viet nay chi mang tinh chat thong tin chung, khong phai tu van ve thue hoac phap ly. Vui long tham khao y kien chuyen gia thue cho truong hop cu the cua ban. Noi dung duoc cap nhat tinh den thang 1 nam 2026.

Cong bo: Day la blog cua Denpyo. Denpyo cung cap dich vu quan ly bien lai va chi phi.

Ngay Quan Trong Khai Thue 2026

| Loai Khai Bao | Thoi Gian/Han Chot |

|---|---|

| Ky khai thue thu nhap | 16 thang 2, 2026 (Thu Hai) - 16 thang 3, 2026 (Thu Hai) |

| Han nop thue | 16 thang 3, 2026 (Thu Hai) |

Gioi Thieu

"Toi co can khai thue o Nhat Ban khong?"

"Lam sao de khai thue bang tieng Anh?"

"Dieu gi xay ra neu toi khong khai thue?"

Neu ban la nguoi nuoc ngoai song tai Nhat Ban, co le ban da tu hoi nhung cau nay. Khai thue tai Nhat Ban (kakutei shinkoku) co ve phuc tap, nhung huong dan nay se giup ban hieu ro.

Huong Dan Nay Bao Gom

- Ai can khai thue va ai khong

- Cac thuat ngu thue quan trong

- Su khac biet giua Mau Xanh va Mau Trang

- Thay doi thue nam 2026

- Huong dan su dung e-Tax tung buoc

- Cac khoan khau tru nguoi nuoc ngoai thuong bo qua

- Nhung viec can lam khi roi Nhat Ban

1. Xac Dinh Xem Ban Co Can Khai Thue Khong

1.1 So Do Kiem Tra Nhanh

Ban co phai la cu dan thue tai Nhat Ban khong?

- Khong: Chi bi danh thue tren thu nhap tu nguon Nhat Ban

- Co: Tiep tuc kiem tra...

Ban chi co mot nguoi su dung lao dong da thuc hien dieu chinh cuoi nam khong?

- Co: Thong thuong ban khong can khai thue

- Khong: Tiep tuc kiem tra...

Ban co thuoc bat ky truong hop nao sau day khong?

- Nhieu nguoi su dung lao dong

- Thu nhap phu tren 200,000 yen

- Thu nhap tu kinh doanh tu do/freelance

- Thu nhap tu bat dong san

- Loi nhuan dau tu can khai bao

Neu co bat ky truong hop nao: Ban can khai thue

1.2 Tinh Trang Cu Tru Thue

Nghia vu thue cua ban duoc xac dinh boi tinh trang cu tru, khong phai loai visa.

| Tinh Trang | Dinh Nghia | Pham Vi Chiu Thue |

|---|---|---|

| Khong Cu Tru (Non-Resident) | O Nhat Ban duoi 1 nam | Chi thu nhap tu nguon Nhat Ban |

| Khong Thuong Tru (Non-Permanent Resident) | O Nhat Ban 1-5 nam trong 10 nam qua, khong co quoc tich Nhat | Thu nhap tu nguon Nhat Ban + thu nhap nuoc ngoai chuyen vao Nhat |

| Thuong Tru (Permanent Resident) | O Nhat Ban tren 5 nam trong 10 nam qua, hoac co quoc tich Nhat | Thu nhap toan cau |

Quan trong: "Thuong tru" ve thue khac voi tu cach cu tru theo luat nhap cu. Ban co the co visa lao dong nhung van la "thuong tru" ve thue neu da song o Nhat du lau.

1.3 Hieu Ve Dieu Chinh Cuoi Nam

Neu ban lam viec cho mot cong ty Nhat Ban, nguoi su dung lao dong cua ban co the da thuc hien dieu chinh cuoi nam (nenmatsu chosei). Day ve co ban la nguoi su dung lao dong khai thue thay ban.

Neu dieu chinh cuoi nam da duoc thuc hien va ban khong co thu nhap khac, thong thuong ban khong can khai thue.

Nguoi su dung lao dong se cung cap cho ban giay chung nhan khau tru tai nguon (gensen choshuhyo) truoc cuoi thang 1. Giu ky tai lieu nay.

2. Tu Vung Thue Quan Trong

Truoc khi bat dau khai thue, hay lam quen voi cac thuat ngu co ban.

| Tieng Nhat | Cach Doc | Tieng Viet | Giai Thich |

|---|---|---|---|

| Xac dinh than cao | kakutei shinkoku | To khai thue cuoi cung | Quy trinh khai thue hang nam |

| Nguon tuyen trung | gensen choshu | Thue khau tru | Thue bi tru tu luong |

| Nguon tuyen trung phieu | gensen choshuhyo | Giay khau tru | Chung tu xac nhan thue khau tru |

| Nam mat dieu chinh | nenmatsu chosei | Dieu chinh cuoi nam | Nguoi su dung lao dong tinh toan thue cuoi nam |

| Kinh phi | keihi | Chi phi | Chi phi kinh doanh duoc khau tru |

| Khong tru | kojo | Khau tru | Khau tru thue |

| Hoan phu | kanpu | Hoan thue | Hoan lai tien thue |

| Thanh sac than cao | aoiro shinkoku | Khai thue Mau Xanh | Phuong phap khai thue voi nhieu khau tru hon |

| Bach sac than cao | shiroiro shinkoku | Khai thue Mau Trang | Phuong phap khai thue don gian |

| So dac thue | shotokuzei | Thue thu nhap | Thue quoc gia |

| Tru dan thue | juminzei | Thue cu tru | Thue dia phuong |

| e-Tax | e-Tax | Thue dien tu | He thong khai thue truc tuyen |

3. So Sanh Khai Thue Mau Xanh va Mau Trang

Neu ban la nguoi tu kinh doanh hoac freelancer, ban can chon giua hai phuong phap khai thue.

3.1 Bang So Sanh

| Hang Muc | Mau Trang | Mau Xanh |

|---|---|---|

| Dang ky truoc | Khong can | Can nop truoc ngay 15 thang 3 |

| Phuong phap ghi chep | Ghi chep don gian | Ke toan kep |

| Khau tru dac biet | Khong | Toi da 650,000 yen |

| Chuyen lo | Khong | 3 nam |

| Phu hop voi | Truong hop don gian | Freelancer/doanh nghiep nghiem tuc |

3.2 Khau Tru 650,000 Yen Cua Mau Xanh

Loi ich lon nhat cua Mau Xanh la khau tru dac biet:

| Dieu Kien | Muc Khau Tru |

|---|---|

| Ke toan kep + Nop qua e-Tax | 650,000 yen |

| Ke toan kep + Nop giay | 550,000 yen |

| Ke toan don gian | 100,000 yen |

Voi nhieu freelancer, dieu nay co nghia la tiet kiem tren 130,000 yen tien thue (o muc thue 20%).

4. Thay Doi Thue Nam 2026

Cai cach thue nam 2025 mang lai mot so uu dai ap dung tu ky khai thue 2026.

4.1 Tang Khau Tru Co Ban

Khau tru co ban duoc tang dang ke:

| Tong Thu Nhap | Truoc Day | Tu 2026 |

|---|---|---|

| Duoi 1,320,000 yen | 480,000 yen | 950,000 yen |

| 1,320,000 - 3,360,000 yen | 480,000 yen | 880,000 yen |

| 3,360,000 - 4,890,000 yen | 480,000 yen | 680,000 yen |

| 4,890,000 - 6,550,000 yen | 480,000 yen | 630,000 yen |

| 6,550,000 - 23,500,000 yen | 480,000 yen | 580,000 yen |

Y nghia: Nguoi co thu nhap thap va trung binh se duoc giam thue tu nam 2026.

4.2 Tang Khau Tru Thu Nhap Tu Luong

Khau tru toi thieu cho nguoi lam cong an luong tang tu 550,000 yen len 650,000 yen.

4.3 Noi Long Dieu Kien Nguoi Phu Thuoc

Gioi han thu nhap cua nguoi phu thuoc duoc noi rong:

- Truoc day: Nguoi phu thuoc phai co thu nhap duoi 480,000 yen

- Tu 2026: Nguoi phu thuoc co the co thu nhap den 580,000 yen

5. Huong Dan Khai Thue Qua e-Tax

5.1 Nhung Gi Ban Can

Bat buoc:

- The My Number (voi ma PIN)

- Dien thoai thong minh ho tro NFC hoac dau doc the IC

- Giay chung nhan khau tru tai nguon tu nguoi su dung lao dong

Neu ap dung:

- Bien lai chi phi y te

- Giay chung nhan bao hiem nhan tho

- Giay chung nhan bao hiem dong dat

- Giay xac nhan quyen gop furusato nozei

- Giay chung nhan dong gop iDeCo

- Bien lai chi phi kinh doanh (nguoi tu kinh doanh)

5.2 Cac Buoc Khai Thue

Buoc 1: Truy cap trang web Co quan Thue Quoc gia

Buoc 2: Chon phuong thuc dang nhap

- The My Number (khuyen nghi) - Su dung ung dung dien thoai hoac dau doc the IC

- ID va Mat khau - Can dang ky truoc tai co quan thue

Buoc 3: Chon loai to khai

Hau het moi nguoi: To khai thue thu nhap

Buoc 4: Nhap thu nhap

- Nhap thong tin tu giay chung nhan khau tru tai nguon

- Them thu nhap kinh doanh va chi phi (neu tu kinh doanh)

- Them cac nguon thu nhap khac

Buoc 5: Nhap cac khoan khau tru

- Khau tru co ban (tu dong tinh)

- Bao hiem xa hoi (tu giay chung nhan khau tru)

- Phi bao hiem nhan tho

- Chi phi y te (neu ap dung)

Buoc 6: Xem lai va gui

- Kiem tra so thue tinh toan

- Neu duong: Ban can nop thue

- Neu am: Ban se duoc hoan thue

- Gui dien tu

Buoc 7: Nop thue (neu can)

- Chuyen khoan ngan hang

- Trich no tu dong

- The tin dung

- Thanh toan tai cua hang tien loi

- Thanh toan tai co quan thue

6. Cac Khoan Khau Tru Nguoi Nuoc Ngoai Thuong Bo Qua

Nhieu nguoi nuoc ngoai dong thue qua nhieu vi khong yeu cau cac khoan khau tru hop le.

6.1 Khau Tru Chi Phi Y Te

Neu chi phi y te cua ho gia dinh ban vuot qua 100,000 yen (hoac 5% thu nhap, tuy theo muc nao thap hon), ban co the khau tru phan vuot qua.

Chi phi duoc tinh:

- Chi phi benh vien va phong kham

- Thuoc theo don

- Chi phi di lai den co so y te

- Dieu tri nha khoa (tru tham my)

- Chi phi sinh con

6.2 Khau Tru Nguoi Phu Thuoc

Ban co the yeu cau khau tru cho:

- Con cai tu 16 tuoi tro len

- Cha me gia (ke ca o nuoc ngoai!)

- Nguoi phu thuoc khac

| Loai Nguoi Phu Thuoc | Muc Khau Tru |

|---|---|

| Nguoi phu thuoc chung | 380,000 yen |

| Nguoi phu thuoc dac biet (19-22 tuoi) | 630,000 yen |

| Nguoi phu thuoc cao tuoi (tu 70 tuoi) | 480,000 - 580,000 yen |

6.3 iDeCo (Quy Huu Tri Ca Nhan)

Dong gop vao iDeCo duoc khau tru 100% khoi thu nhap.

| Loai Hinh Viec Lam | Han Muc Hang Thang |

|---|---|

| Tu kinh doanh | 68,000 yen |

| Nhan vien (khong co luong huu cong ty) | 23,000 yen |

| Nhan vien (co luong huu cong ty) | 12,000 yen |

6.4 Khau Tru Bao Hiem Xa Hoi

Tat ca cac khoan dong bao hiem xa hoi deu duoc khau tru:

- Bao hiem y te

- Luong huu

- Bao hiem that nghiep

Thong thuong da duoc tu dong ghi tren giay chung nhan khau tru tai nguon.

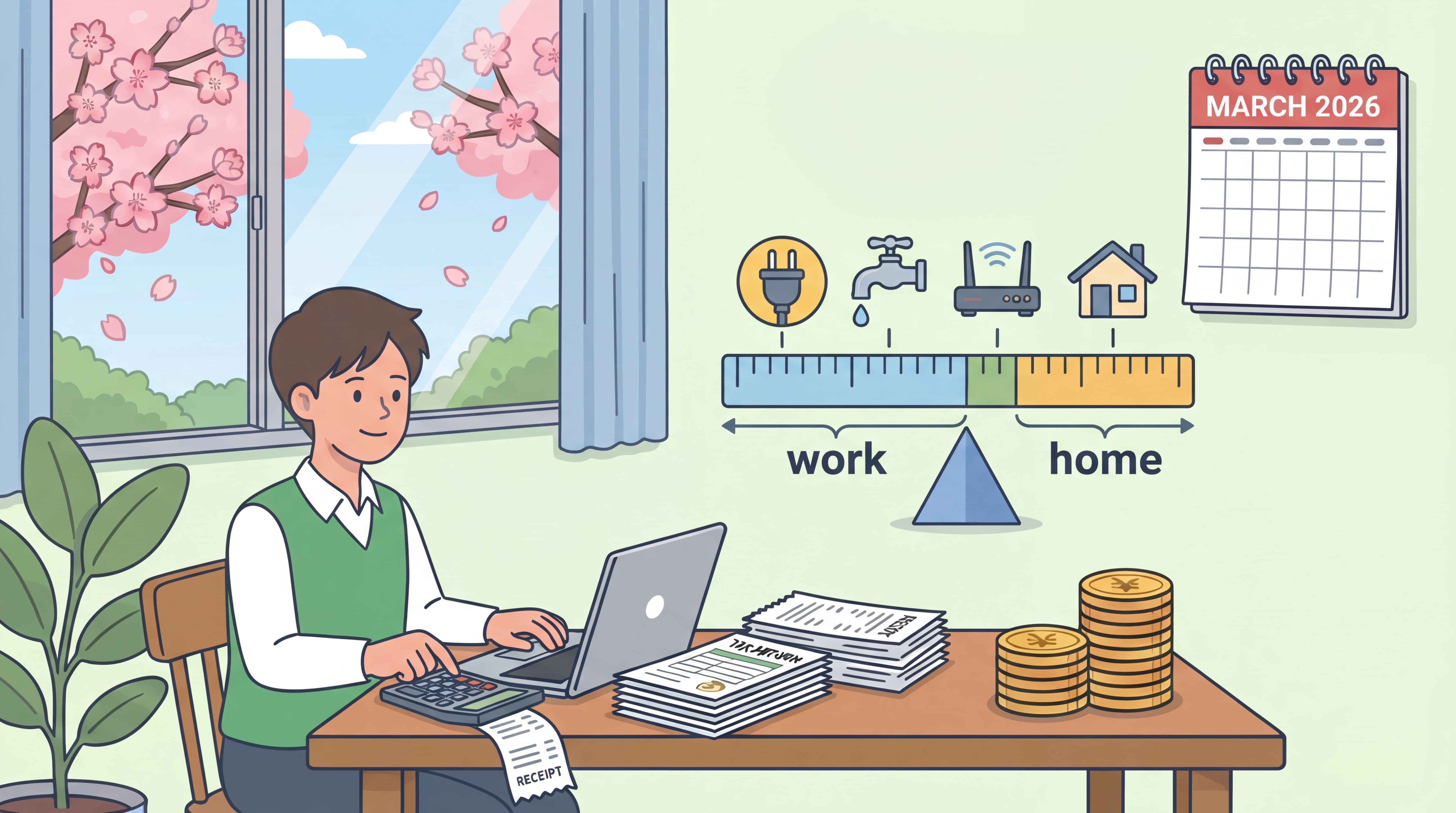

6.5 Chi Phi Lam Viec Tai Nha

Neu ban lam viec tai nha, ban co the khau tru mot phan:

- Tien thue nha (ty le)

- Tien dien nuoc

- Phi internet

Cong thuc: (Dien tich lam viec / Tong dien tich) x Chi phi hang thang x 12 thang

7. Khi Roi Khoi Nhat Ban

7.1 Khai Thue Truoc Khi Xuat Canh

Neu ban roi Nhat Ban truoc ky khai thue thong thuong (thang 2-3), ban co hai lua chon:

Lua chon 1: Khai thue som

- Nop to khai truoc khi roi di

- Bao cao thu nhap tu ngay 1 thang 1 den ngay xuat canh

Lua chon 2: Chi dinh dai dien thue

- Chi dinh mot nguoi o Nhat Ban lam dai dien thue cua ban

- Nop mau dang ky tai co quan thue

- Dai dien se khai thue va nop thue thay ban

7.2 Hoan Luong Huu Mot Lan

Neu ban da dong vao he thong luong huu Nhat Ban tu 6 thang tro len, ban co the duoc hoan luong huu mot lan sau khi roi Nhat Ban.

Thoi han: Trong vong 2 nam sau khi roi Nhat Ban

Quy trinh:

- Roi khoi Nhat Ban

- Lay mau don yeu cau hoan luong huu

- Nop cho Co quan Luong huu Nhat Ban kem tai lieu

- Nhan thanh toan (bi khau tru 20%)

- Yeu cau hoan lai phan khau tru neu ap dung

7.3 Thue Xuat Canh

Day chi ap dung neu ban co tai san tai chinh tren 100 trieu yen. Hau het moi nguoi khong can lo lang ve dieu nay.

8. Noi Tim Kiem Ho Tro

8.1 Tai Nguyen Mien Phi

Duong day tu van da ngon ngu cua Co quan Thue Quoc gia:

- Dien thoai: 0570-003-388

- Ngon ngu: Tieng Anh va cac ngon ngu khac

- Gio lam viec: Ngay trong tuan 8:30-17:00

Tu van tai co quan thue:

- Co quan thue cung cap tu van mien phi trong ky khai thue

- Mang theo tat ca tai lieu

- Phien dich co the co san (goi dien truoc de xac nhan)

8.2 Khi Nao Nen Thue Chuyen Gia

Can nhac thue ke toan thue (zeirishi) neu:

- Ban co thu nhap kinh doanh phuc tap

- Ban co nhieu nguon thu nhap

- Ban dau tu bat dong san

- Ban co thu nhap hoac tai san o nuoc ngoai

- Ban muon yeu cau cac khoan khau tru lon

Chi phi: 30,000-100,000+ yen tuy theo do phuc tap

9. Cau Hoi Thuong Gap

H1: Toi co the khai thue bang tieng Anh khong?

Tra loi: Rat tiec, cac mau chinh thuc chi co tieng Nhat. Tuy nhien, ban co the su dung tinh nang dich cua trinh duyet, va mot so ke toan thue noi tieng Anh.

H2: Neu toi mac loi trong to khai truoc?

Tra loi: Ban co the nop to khai sua doi trong vong 5 nam. Neu da dong qua nhieu, ban co the yeu cau hoan thue.

H3: Toi co can khai bao thu nhap tu nuoc nha khong?

Tra loi: Phu thuoc vao tinh trang cu tru thue cua ban:

- Khong thuong tru: Chi khi chuyen vao Nhat Ban

- Thuong tru (5+ nam): Co, thu nhap toan cau bi danh thue

Hiep dinh thue co the giup giam thue hai lan.

H4: Cong ty da lam dieu chinh cuoi nam, toi co can khai thue khong?

Tra loi: Thong thuong khong. Tuy nhien, ban can khai thue neu:

- Ban co thu nhap khac

- Ban muon yeu cau them khau tru

- Ban co thu nhap tu cong ty cu nghi giua nam

Danh Sach Kiem Tra

Truoc Ky Khai Thue (Den Thang 1)

- Xac nhan xem ban co can khai thue khong

- Nhan giay chung nhan khau tru tai nguon tu nguoi su dung lao dong

- Thu thap bien lai cho cac khoan khau tru

- Chuan bi the My Number cho e-Tax

Trong Ky Khai Thue (16/2 - 16/3)

- Truy cap e-Tax hoac chuan bi to khai giay

- Nhap thong tin thu nhap

- Yeu cau tat ca cac khoan khau tru ap dung

- Nop to khai

- Nop thue (truoc ngay 16 thang 3)

Sau Khai Thue

- Luu giu ban sao tat ca tai lieu (7 nam)

- Hoan thue se den trong 1-2 thang neu co

- Dat nhac nho cho nam sau

Lien Ket Huu Ich

| Tai Nguyen | Dia Chi |

|---|---|

| Co quan Thue Quoc gia (Tieng Anh) | https://www.nta.go.jp/english/index.htm |

| Cong e-Tax | https://www.e-tax.nta.go.jp/ |

| Co quan Luong huu Nhat Ban | https://www.nenkin.go.jp/international/ |

| Duong day tu van da ngon ngu | 0570-003-388 |

🧮 Công Cụ Thuế Miễn Phí Cho Người Nước Ngoài

Chuẩn bị khai thuế tại Nhật với công cụ miễn phí:

- → Máy Tính Thuế Thu Nhập — Tính thuế thu nhập Nhật Bản

- → Kiểm Tra Yêu Cầu Khai Thuế — Kiểm tra có cần khai thuế không

- → Danh Sách Kiểm Tra Khai Thuế — Danh sách tài liệu đầy đủ

Theo dõi chi phí, tối đa hóa khấu trừ

Denpyo quét hóa đơn của bạn và tự động tìm khoản tiết kiệm thuế.