Home Office Deduction (家事按分) Japan 2026: Calculate Work-From-Home Expenses

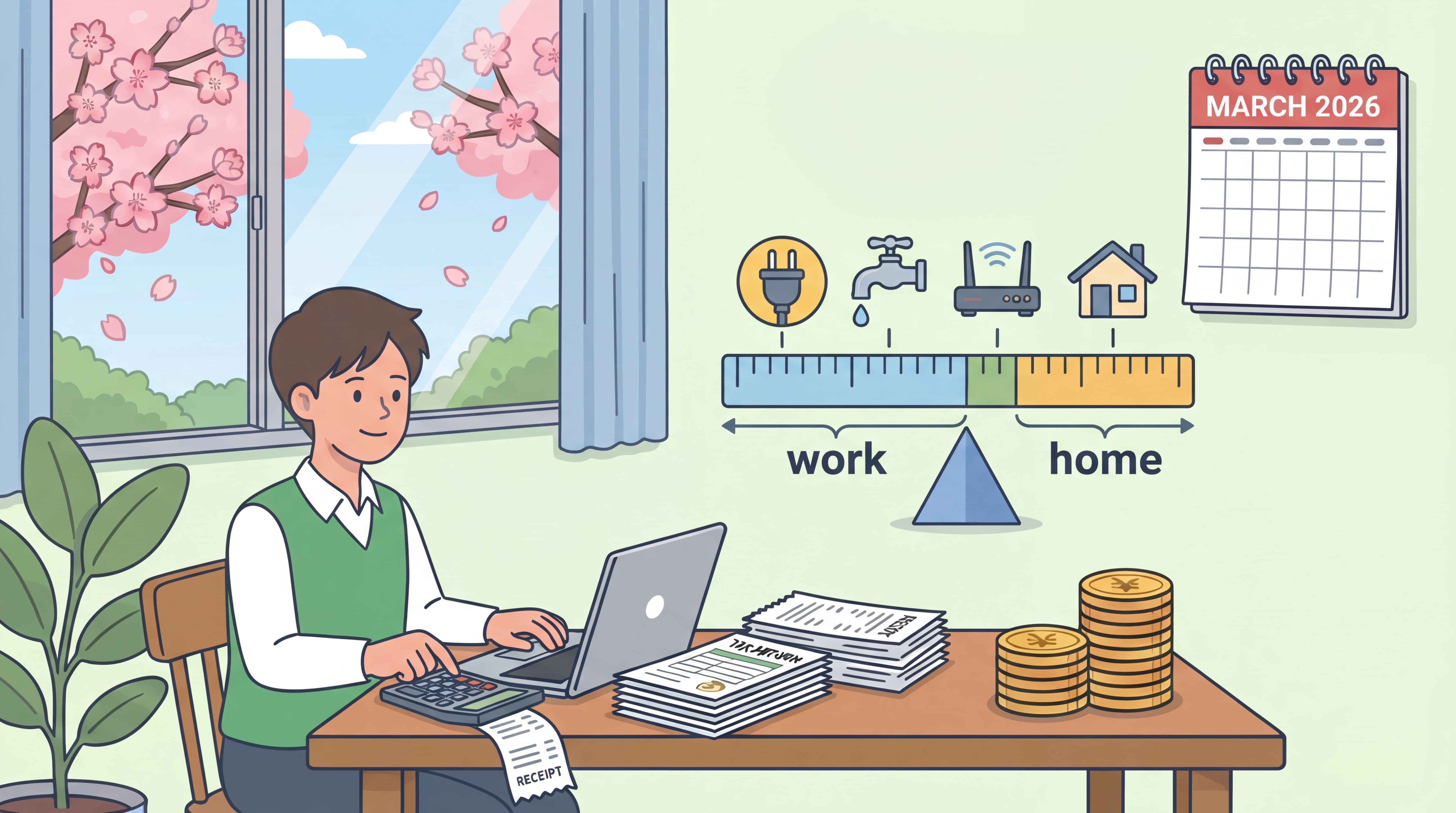

Learn how to calculate Japan's home office deduction (kajianbu) for remote workers. Deduct rent, electricity, and internet using floor area or time-based allocation methods.

Disclaimer: This article provides general information only and does not constitute tax or legal advice. Please consult a qualified tax professional (zeirishi) for your specific situation.

Introduction: How Much of Your Home Expenses Can You Deduct?

"I work from home, but can I deduct rent and electricity as business expenses?"

Since the pandemic, remote work has become common. For freelancers and sole proprietors working from home in Japan, 家事按分 (kajianbu / home office allocation) is a crucial tax-saving opportunity that many foreigners overlook.

What you'll learn in this article:

- What 家事按分 (home office allocation) is

- Types of expenses you can allocate

- Specific calculation methods (floor area vs. time-based)

- Points for tax audit approval

- Common mistakes to avoid

1. What is 家事按分 (Home Office Allocation)?

1.1 The Basic Concept

家事按分 (kajianbu) is a method of splitting expenses according to your business use ratio when you use your home for both business and personal life.

For example, if you pay ¥100,000 rent and use 30% of your home for work, you can deduct ¥30,000 per month as a business expense.

1.2 Why Allocation is Required

For tax purposes, only expenses directly related to business are deductible. Since home rent and utilities include personal use, you cannot deduct the full amount.

Benefits of Home Office Allocation:

- Deduct home expenses even without a separate office

- Properly calculated ratios hold up in tax audits

- Significant tax savings potential

2. Types of Expenses You Can Allocate

| Expense | Allocation Method | Notes |

|---|---|---|

| Rent | Floor area | Work room area ÷ Total area |

| Electricity | Floor area or Time | Either method acceptable |

| Gas | △ Limited | Only if used for business |

| Water | △ Limited | Only if used for business |

| Internet | Time-based | Work hours ÷ Total usage hours |

| Mobile phone | Time or Call records | Business usage percentage |

| Mortgage interest | Floor area | Principal not deductible, interest only |

| Property tax | Floor area | If you own the property |

| Fire insurance | Floor area | Both owned and rented |

3. Calculation Method: Floor Area Allocation

3.1 Basic Formula

Deductible Amount = Total × (Work Space Area ÷ Total Home Area)

3.2 Example: Rent Calculation

Conditions:

- Total home area: 60㎡

- Work room area: 12㎡

- Monthly rent: ¥120,000

Calculation:

Allocation ratio = 12㎡ ÷ 60㎡ = 20% Monthly expense = ¥120,000 × 20% = ¥24,000 Annual expense = ¥24,000 × 12 months = ¥288,000

Tax Savings (at 20% income tax rate):

¥288,000 × 20% = ¥57,600 in tax savings

3.3 When You Don't Have a Dedicated Work Space

You can still allocate expenses even if you work in a corner of your living room.

Methods:

- Measure the area where your desk is placed

- Or use: Room area × Percentage of time used for work

4. Calculation Method: Time-Based Allocation

4.1 Basic Formula

Deductible Amount = Total × (Work Hours ÷ Total Usage Hours)

4.2 Example: Electricity

Conditions:

- Monthly electricity: ¥15,000

- Daily hours at home: 16 hours

- Daily work hours: 8 hours

Calculation:

Allocation ratio = 8 hours ÷ 16 hours = 50% Monthly expense = ¥15,000 × 50% = ¥7,500 Annual expense = ¥7,500 × 12 months = ¥90,000

4.3 Example: Internet

Conditions:

- Monthly internet: ¥5,000

- Weekly work hours: 40 hours

- Weekly personal hours: 20 hours

Calculation:

Allocation ratio = 40 hours ÷ 60 hours = 66.7% (round to 70%) Monthly expense = ¥5,000 × 70% = ¥3,500

5. Points for Tax Audit Approval

5.1 Have Reasonable Basis

In a tax audit, you need to explain the reasonable basis for your allocation ratio.

Accepted Bases:

- Floor plan showing work space area

- Calendar or work records

- Call history (for mobile phone)

5.2 Keep Supporting Documents

| Document | Purpose |

|---|---|

| Floor plan | Basis for area allocation |

| Lease agreement | Proof of rent amount |

| Utility bills | Proof of amounts |

| Work diary/time records | Basis for time allocation |

5.3 Allocation Ratio Guidelines

Generally accepted allocation ratios:

| Expense | Typical Ratio |

|---|---|

| Rent | 10%-50% |

| Electricity | 20%-50% |

| Internet | 50%-80% |

| Mobile phone | 30%-70% |

⚠️ Warning: Excessively high ratios may be denied during tax audits.

6. Annual Home Office Deduction Simulation

Typical Freelancer Case:

| Expense | Monthly | Ratio | Monthly Deduction | Annual Deduction |

|---|---|---|---|---|

| Rent | ¥100,000 | 25% | ¥25,000 | ¥300,000 |

| Electricity | ¥12,000 | 40% | ¥4,800 | ¥57,600 |

| Gas | ¥5,000 | 10% | ¥500 | ¥6,000 |

| Water | ¥4,000 | 10% | ¥400 | ¥4,800 |

| Internet | ¥5,000 | 70% | ¥3,500 | ¥42,000 |

| Mobile | ¥8,000 | 50% | ¥4,000 | ¥48,000 |

| Total | ¥38,200 | ¥458,400 |

Tax Savings (at 20% income tax + 10% residence tax = 30%):

¥458,400 × 30% = Approximately ¥137,500 in tax savings

7. Frequently Asked Questions

Q1: Can I allocate expenses for rental housing?

A: Yes, you can. Home office allocation works for both rental and owned property.

Q2: Can I deduct mortgage payments?

A: Mortgage principal is not deductible, but the interest portion can be allocated and deducted.

Q3: Can I change the allocation ratio every year?

A: Yes, if your situation changes. However, significant changes require clear justification.

Q4: Can I use allocation for side jobs?

A: Yes, if filing as business income. However, side jobs filed as miscellaneous income may not qualify.

Q5: What about condo management fees?

A: Management fees can be allocated and deducted the same as rent.

8. Cautions and Common Mistakes

8.1 What NOT to Do

❌ Deduct the full amount — Allocation is always required

❌ Set high ratios without basis — Risk of denial in audit

❌ Change ratios every month — Consistency required

❌ Fail to keep records — Can't explain during audit

Summary

With proper home office allocation, remote workers can save tens of thousands of yen per year in taxes.

Key Takeaways:

1. Choose floor area or time allocation — Select appropriate method for each expense 2. Set reasonable ratios — Too high risks denial 3. Keep supporting documents — Floor plans, contracts, work records 4. Be consistent — Use same calculation method each year 5. Consult a professional — Ask a tax accountant if unsure

2026 Tax Filing Deadline: March 16 (Monday)

Streamline Expense Management with Denpyo

Just photograph your receipts and AI automatically categorizes them. Supports home office allocation calculations.

Related Articles

Last updated: February 2026

Author: Denpyo Content Team

Track expenses, maximize deductions

Denpyo scans your receipts and finds tax savings automatically.