Tax Tips

Tax saving tips for small businesses in Japan

Life Insurance Premium Deduction 2026: Complete Guide to Seimei Hoken Deduction, 3 Categories & ¥120,000 Tax Savings

If you have life insurance in Japan, you may be eligible for up to ¥120,000 in annual income deductions (seimei hoken-ryō kōjo). This translates to significant savings on both income and residence taxes. Yet many people don't claim this deduction. Proper application often results in tax refunds or reductions worth tens of thousands of yen.

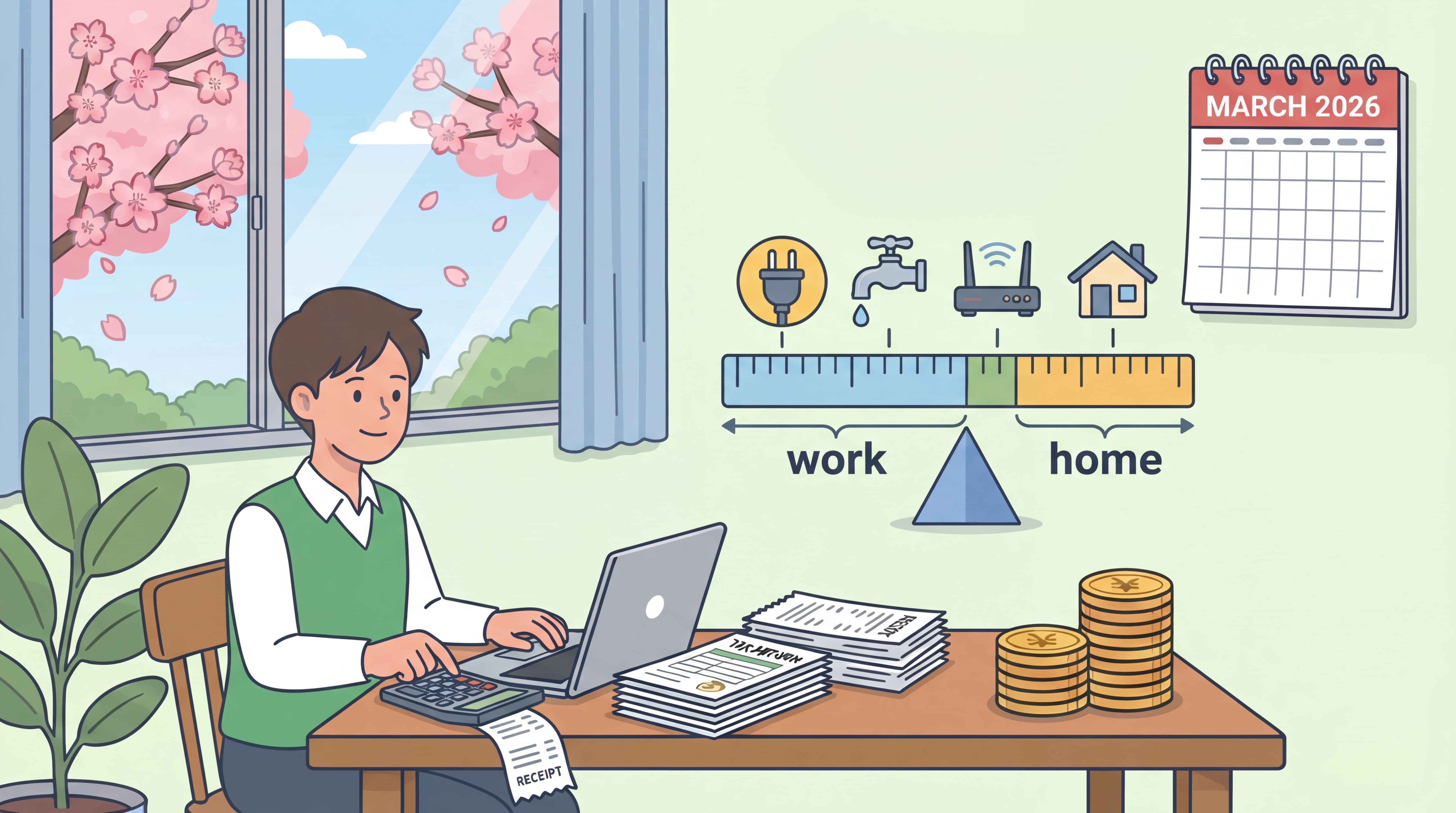

Home Office Deduction (家事按分) Japan 2026: Calculate Work-From-Home Expenses

Learn how to calculate Japan's home office deduction (kajianbu) for remote workers. Deduct rent, electricity, and internet using floor area or time-based allocation methods.

Receipt Storage Requirements Guide for Japan 2026

You must keep receipts for a long time even after filing your taxes in Japan — 7 years if you are a blue return filer, 5 years for white return filers. This guide covers valid documents, digital storage rules, and what to do if you lose a receipt.

Expense Categories (勘定科目) Guide for Japan Freelancers 2026

Complete guide to Japanese expense categories (kamoku) for tax filing. Learn how to classify receipts correctly for travel, supplies, entertainment & more.

2026 Housing Loan Deduction Guide | First-Year Filing for Japan Mortgages

Bought a home in Japan? Learn how to claim the housing loan deduction in your first year. Required documents, calculation methods, and e-Tax filing steps.

Tax Filing After Resignation 2026 | How Much Refund for Mid-Year Quitting? | Denpyo

Quit your job mid-year in Japan? Get tax refunds through filing. 2026 refund simulation, required documents, e-Tax filing guide. Covers retirement income tax and mid-year resignation procedures.

2026 Japan Crypto Tax Guide: Calculation Methods & Tax Rates Explained | Denpyo

Complete guide to filing cryptocurrency taxes in Japan 2026. Bitcoin, Ethereum profit calculation, tax rates up to 55%, NTA tools, and common mistakes to avoid.

2026 Tax Filing: e-Tax Home Filing Guide — File Your Japanese Taxes from Home with My Number Card + Smartphone

"Tax filing is such a hassle..." "I don't have time to go to the tax office..." "I don't understand Japanese tax forms..." If you're a foreigner living in Japan, these concerns are completely understandable.

How to File Taxes for Side Jobs Without Your Employer Knowing (Japan 2026)

"I want to start a side job, but what if my company finds out?" The main reason side jobs get discovered is residence tax. By selecting "ordinary collection" on your tax return, your company won't be notified. A thorough guide to correct filing methods for 2026.

Who Needs to File a Tax Return in Japan 2026: Complete Checklist

"Do I need to file a tax return?" 2026 brings significant changes to the basic deduction from tax reforms. A complete checklist guide explaining who needs to file and who doesn't - company employees, freelancers, side job workers, and pension recipients.

Year-End Adjustment vs Tax Return: Complete Guide 2026 | Japan Employees

Year-end adjustment vs tax return (kakuteishinkoku) explained. When you need both, 2026 changes, and side-job implications. Essential for Japan employees.

Blue Form vs White Form Tax Filing 2026: The Complete Guide for First-Year Freelancers in Japan

Blue Form (Aoiro) vs White Form (Shiroiro) tax filing compared. ¥650K special deduction requirements, income-based tax simulations, application deadlines for freelancers in Japan.