Tax Filing After Resignation 2026 | How Much Refund for Mid-Year Quitting? | Denpyo

Quit your job mid-year in Japan? Get tax refunds through filing. 2026 refund simulation, required documents, e-Tax filing guide. Covers retirement income tax and mid-year resignation procedures.

Disclaimer: This article provides general information only and does not constitute tax or legal advice. Please consult a qualified tax professional (zeirishi) for advice specific to your situation. Information is based on official National Tax Agency (NTA) sources and current as of January 2026.

Disclosure: This article is published by Denpyo, a receipt and expense management service. Some tools and services mentioned include Denpyo products.

Introduction: Can You Get Tax Refunds After Quitting Your Job?

"I quit my job, but do I need to file a tax return?"

"I didn't receive year-end adjustment — what should I do?"

If you resigned mid-year in Japan, you haven't received year-end tax adjustment (nenmatsu chousei), which means you likely need to file a tax return (kakutei shinkoku) to recover overpaid taxes.

Here's the good news: tax filing after resignation is optional, not mandatory in most cases. But by filing, you could receive refunds of tens to hundreds of thousands of yen.

In 2026 especially, with the significant expansion of the basic deduction (kiso koujo), refund amounts may be higher than in previous years.

What you'll learn in this article:

- When tax filing is required vs. optional after resignation

- Refund estimates based on when you quit

- Required documents and how to prepare them

- Step-by-step e-Tax filing process

- How severance pay (retirement allowance) is taxed

- What to do if you changed jobs mid-year

1. When Tax Filing is Required After Resignation

1.1 Cases Where Filing is Mandatory

| Situation | Filing Status |

|---|---|

| Resigned with annual income over 20 million yen | Required (Mandatory) |

| Side income over 200,000 yen after resignation | Required (Mandatory) |

| Didn't submit "Retirement Income Declaration" form | Required (Mandatory) |

1.2 Cases Where Filing is Optional but Likely Results in Refund

| Situation | Refund Potential |

|---|---|

| Resigned mid-year, unemployed at year-end | High |

| Re-employed but previous income not included in year-end adjustment | High |

| Medical expenses over 100,000 yen after resignation | High |

| Made Furusato Nozei donations after resignation | High |

1.3 Why Do You Get Tax Refunds After Resignation?

For employees in Japan, income tax is withheld from your monthly salary (gensen choushuu). This withholding amount is calculated assuming you'll work the entire year at your current salary level.

When you resign mid-year, you've effectively overpaid your taxes because the withholding was based on a higher annual income than you actually earned.

Example:

| Item | Amount |

|---|---|

| Salary income (January-June) | 3,000,000 yen |

| Tax withheld during employment | Approx. 150,000 yen |

| Actual annual income (only 3M yen) | 3,000,000 yen |

| Correct tax amount based on actual income | Approx. 50,000 yen |

| Refund amount | Approx. 100,000 yen |

The withholding was calculated assuming "annual income of 6 million yen," but your actual income was only 3 million yen. The difference comes back to you as a refund.

2. Refund Estimates by Resignation Month

2.1 Estimated Refunds Based on When You Quit

Assumptions: Monthly salary 300,000 yen (annual equivalent 3.6M yen), single, no dependents

| Resignation Month | Annual Income | Tax Withheld | Correct Tax | Estimated Refund |

|---|---|---|---|---|

| End of March | 900,000 yen | ~20,000 yen | 0 yen | ~20,000 yen |

| End of June | 1,800,000 yen | ~50,000 yen | ~10,000 yen | ~40,000 yen |

| End of September | 2,700,000 yen | ~100,000 yen | ~50,000 yen | ~50,000 yen |

*Due to the expanded basic deduction in 2026, actual refund amounts may be even higher than these estimates.

2.2 Impact of the 2026 Basic Deduction Expansion

Starting from Reiwa 7 (2025 income, filed in 2026), the basic deduction has been significantly expanded:

| Total Income | New Basic Deduction | Old Basic Deduction |

|---|---|---|

| 1.32M yen or less | 950,000 yen | 480,000 yen |

| 3.36M yen or less | 880,000 yen | 480,000 yen |

| 6.55M yen or less | 580,000 yen | 480,000 yen |

Impact on Resigned Workers:

If your income is lower due to mid-year resignation, a larger basic deduction applies, potentially increasing your refund compared to previous years.

Source: NTA - Basic Deduction Revision for Reiwa 7 Tax Reform

3. Required Documents and Preparation

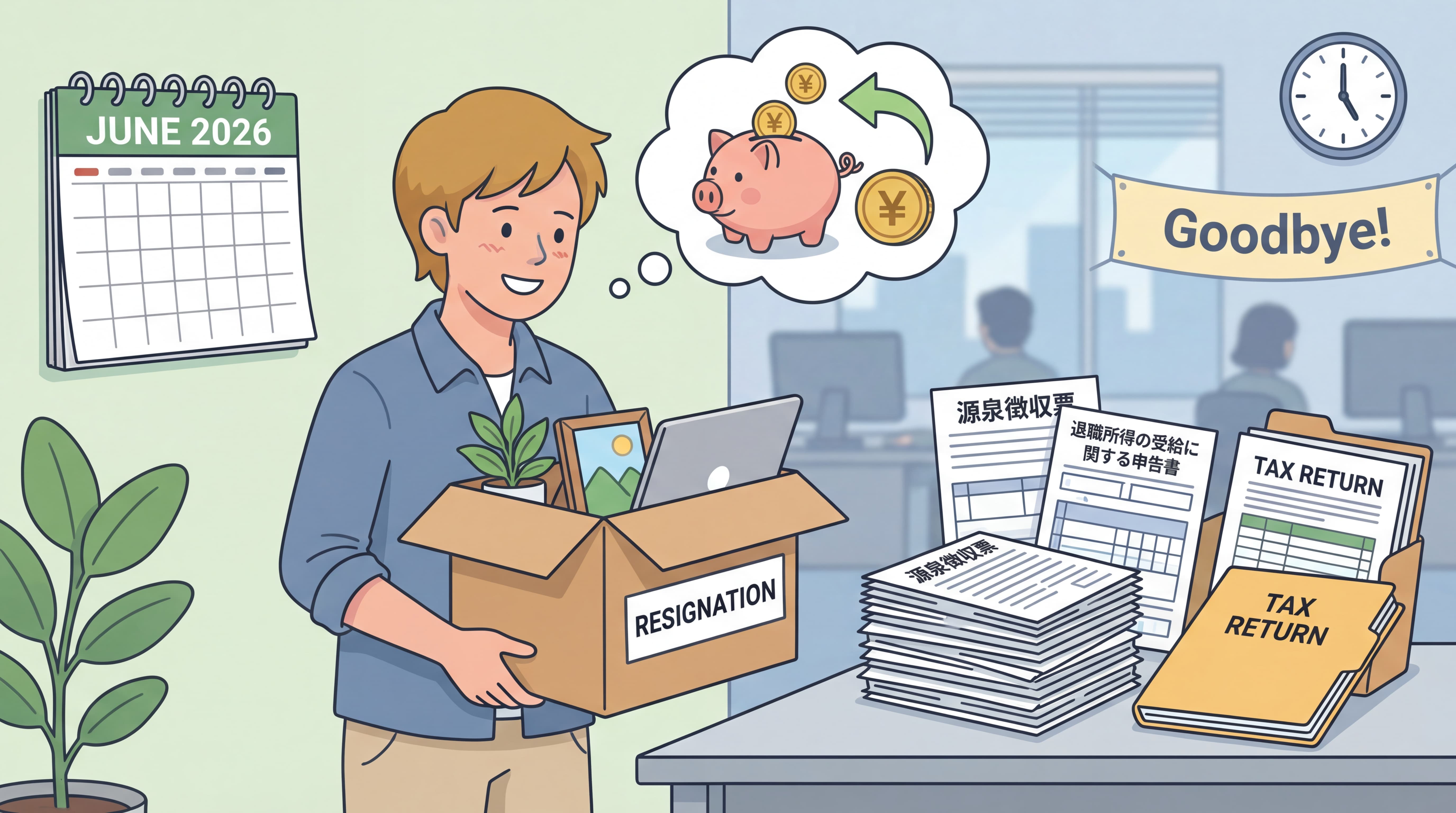

3.1 Essential Documents

| Document | How to Obtain |

|---|---|

| Withholding Tax Statement (gensen choushuu-hyou) | Issued by your employer when you resign |

| My Number Card (mainambaa kaado) | Obtain from your municipal office (shiyakusho/kuyakusho) |

| Bank Account Information | For receiving your refund (must be in your name) |

3.2 If You Don't Have Your Withholding Statement

Your former employer is legally required to issue your withholding tax statement within 1 month of your resignation date. If you haven't received it:

- Contact your former employer and request reissuance

- If they don't respond, consult your local tax office (zeimusho)

3.3 Additional Documents for Claiming Deductions

| Deduction Type | Required Documents |

|---|---|

| Medical Expense Deduction | Medical receipts, expense statements, health insurance notifications |

| Furusato Nozei | Donation receipt certificates (kifu-kin jushou shoumeisho) |

| Life Insurance Deduction | Premium deduction certificates from insurers |

| Social Insurance Deduction | Receipts for National Health Insurance (NHI) and National Pension paid after resignation |

Important: Premiums you paid yourself for National Health Insurance (kokumin kenko hoken) and National Pension (kokumin nenkin) after resignation are fully deductible! Keep all receipts.

4. How Severance Pay (Retirement Allowance) is Taxed

4.1 Retirement Allowance Gets Favorable Tax Treatment

Severance pay is taxed as "retirement income" (taishoku shotoku), which is separate from your regular salary income and receives preferential tax treatment.

Retirement Income Calculation Formula:

Retirement Income = (Retirement Allowance - Retirement Income Deduction) × 1/2

4.2 Retirement Income Deduction Amounts

| Years of Service | Deduction Amount |

|---|---|

| 20 years or less | 400,000 yen × years of service |

| Over 20 years | 8,000,000 yen + 700,000 yen × (years - 20) |

Example: 10 years of service, 5,000,000 yen severance pay

- Retirement Income Deduction = 400,000 × 10 = 4,000,000 yen

- Taxable Retirement Income = (5,000,000 - 4,000,000) × 1/2 = 500,000 yen

- Tax on retirement income = Approximately 25,000 yen

4.3 The Critical "Retirement Income Declaration" Form

If you submitted the "Retirement Income Declaration" (taishoku shotoku no jukyuu ni kansuru shinkokusho) to your company when you resigned, the appropriate tax is already withheld from your severance pay, and no tax filing is required for this income.

Warning: If you didn't submit this form, a flat 20.42% is withheld from your retirement allowance. This is likely much higher than your actual tax liability, so you'll need to file a tax return to get a substantial refund.

5. What to Do If You Changed Jobs

5.1 If You Found New Employment Within the Same Year

If you joined a new company within the same calendar year, you can receive year-end adjustment at your new employer that covers both jobs.

Required Steps:

- Obtain your withholding statement from your previous employer

- Submit the withholding statement to your new employer

- Your new employer performs a combined year-end adjustment

In this case, tax filing is generally unnecessary.

5.2 Cases Where Tax Filing is Still Required

Even when changing jobs, tax filing is required in these situations:

| Situation | Reason |

|---|---|

| Didn't submit previous withholding statement to new employer | Previous income not included in year-end adjustment |

| Joined new company in December, missed year-end adjustment deadline | No year-end adjustment was performed |

| Want to claim medical expense or Furusato Nozei deductions | These deductions cannot be handled by year-end adjustment |

6. e-Tax Filing Step-by-Step

6.1 Preparation

- Have your withholding statement ready

- Prepare your My Number Card (ensure it's not expired)

- Install the My Number Portal app on your smartphone

6.2 Filing Process

Step 1: Access the Tax Return Preparation Corner

Step 2: Click "Start Preparation" and select "e-Tax"

Step 3: Select your return type

- Choose "Income Tax" (shotoku-zei)

Step 4: Enter your income information

- Select "Salary Income" (kyuuyo shotoku)

- Enter the details from your withholding statement

Step 5: Enter deductions

- Social insurance deduction (for premiums paid after resignation)

- Medical expense deduction (if applicable)

- Furusato Nozei (if applicable)

Step 6: Review your tax calculation

- Your refund amount will be displayed

Step 7: Sign and submit electronically

- Authenticate with your My Number Card

- Submit via e-Tax

6.3 Receiving Your Refund

| Filing Method | Approximate Refund Time |

|---|---|

| e-Tax | About 3 weeks |

| Paper filing | 1-2 months |

Your refund will be deposited into the bank account you specified on your tax return.

7. Refund Filing Deadline

7.1 You Have 5 Years to File for a Refund

Refund filing (kanpu shinkoku) is not restricted to the official tax filing period (February 16 - March 16). This is one of the most important things to know!

| Item | Deadline |

|---|---|

| Refund filing can start | January 1, 2026 |

| Refund filing deadline | December 31, 2030 (5 years from the tax year) |

7.2 You Can Claim Refunds for Past Years Too

Even if you resigned within the past 5 years and never filed a tax return, you can file now and receive a refund.

Years you can still file for (if filing in 2026):

- 2021 (Reiwa 3) through 2025 (Reiwa 7)

8. Frequently Asked Questions (FAQ)

Q1: Do I need to file if I'm still unemployed after resignation?

A: Filing is not mandatory, but we strongly recommend it. Since you didn't receive year-end adjustment, you almost certainly have overpaid taxes to recover. Don't leave money on the table!

Q2: Do I report unemployment insurance benefits on my tax return?

A: No. Unemployment insurance benefits (shitsugyou kyuufu) are tax-exempt in Japan, so you don't need to report them on your tax return.

Q3: Do I always need to file if I received severance pay?

A: If you submitted the "Retirement Income Declaration" form to your company, filing is unnecessary for the severance pay. If you didn't submit this form, you should file because too much tax was withheld, and you're owed a refund.

Q4: What if I forgot to include National Health Insurance premiums as a deduction?

A: You can file a Request for Reassessment (kousei no seikyuu) within 5 years to receive additional refunds.

Q5: Do I need to file residence tax (juminzei) separately?

A: No. When you file an income tax return, the information is automatically sent to your municipal government, so a separate residence tax filing is unnecessary.

9. For Those Planning to Resign: Prepare Now

9.1 Before You Resign

- Confirm your company will provide the "Retirement Income Declaration" form

- Ask when your withholding statement will be issued

- Understand how to continue social insurance after resignation

9.2 After You Resign

- Receive your withholding statement (should arrive within 1 month)

- Switch to National Health Insurance and National Pension

- Keep all medical expense and insurance payment receipts

- Prepare for tax filing (starting in January)

Summary

Let's recap the key points of tax filing after resignation in Japan.

5 Things to Remember:

- High refund potential if you resigned mid-year — Without year-end adjustment, you've almost certainly overpaid taxes

- Always obtain your withholding statement — This document is essential for filing; request it from your former employer if you haven't received it

- Social insurance paid after resignation is deductible — Keep all receipts for National Health Insurance and National Pension premiums

- Refund filing is valid for 5 years — You can claim past years too, not just the current year

- e-Tax refunds arrive in about 3 weeks — Much faster than paper filing (1-2 months)

2026 Tax Filing Deadline: March 16 (Monday)

*Refund filing is accepted starting January 1 — beat the rush!

Tax Return Preparation Corner

Check if you need to file a tax return

Useful Links

- Tax Return Preparation Corner — NTA's official e-Tax filing portal

- My Number Portal — Manage your My Number Card and linked services

- Start Expense Management with Denpyo — Track receipts and expenses for tax filing

Related Tools

| Tool Name | Purpose | Link |

|---|---|---|

| Income Tax Calculator | Refund simulation | /tools/income-tax-calculator |

| Filing Requirement Checker | Determine if filing is needed | /tools/filing-check |

Key Japanese Terms Glossary

| English | Japanese | Romaji | Description |

|---|---|---|---|

| Resignation | 退職 | taishoku | Quitting or leaving a job |

| Year-End Tax Adjustment | 年末調整 | nenmatsu chousei | Annual tax settlement done by employers in December |

| Withholding Tax Statement | 源泉徴収票 | gensen choushuu-hyou | Annual income and tax document from employer |

| Refund Filing | 還付申告 | kanpu shinkoku | Tax return filed specifically to receive a refund |

| Retirement Income | 退職所得 | taishoku shotoku | Taxable income category for severance pay |

| Severance Pay / Retirement Allowance | 退職金 | taishokukin | Lump-sum payment received upon leaving a company |

| Basic Deduction | 基礎控除 | kiso koujo | Standard deduction available to all taxpayers |

| Tax Return | 確定申告 | kakutei shinkoku | Annual income tax declaration |

| Tax Office | 税務署 | zeimusho | Local tax authority office |

| National Health Insurance | 国民健康保険 | kokumin kenko hoken | Health insurance for self-employed, unemployed, etc. |

| National Pension | 国民年金 | kokumin nenkin | Basic pension program for all residents |

| Retirement Income Declaration | 退職所得の受給に関する申告書 | taishoku shotoku no jukyuu ni kansuru shinkokusho | Form that ensures proper tax withholding from severance |

| Request for Reassessment | 更正の請求 | kousei no seikyuu | Request to correct a previously filed return |

| Unemployment Insurance | 失業保険/雇用保険 | shitsugyou hoken / koyou hoken | Government unemployment benefits |

References & Sources

- NTA - Withholding Tax Quick Reference for Retirement Income

- NTA - Tax Return Preparation Corner

- NTA - Basic Deduction Revision for Reiwa 7 Tax Reform

- NTA - About Refund Filing

Last Updated: January 2026

Author: Denpyo Content Team

Track expenses, maximize deductions

Denpyo scans your receipts and finds tax savings automatically.